WEDGE Dia-log was formed in 1996 with the acquisition of The Dia-Log Company and Log-Tech Wireline, which were merged with WEDGE Wireline forming one of the world’s major cased hole wireline companies. In 1998, the company was sold to Western Atlas for approximately $165 million.

PRIVATE INVESTMENTS

REALIZED REAL ESTATE INVESTMENTS

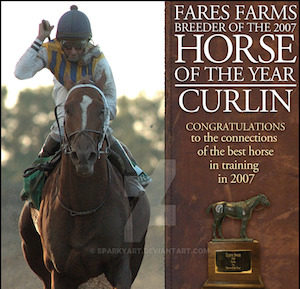

Fares Farms, a 700+ acre thoroughbred farm in Lexington Kentucky, bred and raced thoroughbreds for more than 25 years. Among the numerous stakes winners bred by Fares Farms are Curlin, named 2007-2008 Horse of the Year and through 2016 was the highest North American money earner with $10.5 million in earnings; and Miss Alleged, winner of the 1991 Breeders’ Cup Turf (G1). The farm conducted a complete dispersal in 2012 and the property was sold in 2016 for $30 million. WEDGE continues its thoroughbred operations through its foreign affiliate, Haras de Manneville located in France.

Stor-A-Way was founded in 1998 by WEDGE to develop and acquire and develop self-storage facilities throughout Texas. By 2011, WEDGE had accumulated a portfolio of 24 facilities with over 1 million square feet of rentable area values. The bulk of the portfolio was sold to Sovran Self Storage (NYSE: SSS) for over $110.0 million. The remainder of the portfolio was liquidated by 2014.

Tonopalo is a 133-unit fractional lakefront resort development on Lake Tahoe’s north shore. The project was completed in 2004 and units were sold out by 2006 at a total sellout more than $60.0 million.

In 1982, WEDGE developed the original first class hotel on Paradise Island, Bahamas and completed construction of a bridge to Nassau. In 1997, WEDGE assumed direct management of the property. The property was sold in 2004 to Riu Hotels.

This prestigious community began in 1981 with WEDGE’s purchase of 2,350 undeveloped acres in Vail Valley. WEDGE added $50.0 million in infrastructure, including the Jack Nicklaus designed Country Club of the Rockies, and built $80.0 million or over 150 residential properties. The development was sold to Vail Associates in 1993.

Additional other hotel and office realized investments:

- Radisson Heritage Hotel – Chelmsford, MA

- Days Inn – Saugus, MA

- Stonehill Corporate Center – Saugus, MA

- Hampton Inn – Portsmouth, NH

- Calistoga Ranch, Napa, CA

- Courtyard by Marriott – Shelton, CO

- Central Park Plaza – Omaha, NE

- Yorktown Plaza – Houston, TX

- DoubleTree Maple Hotel – Chelsea, MA

- Hilton Garden Inn – Winston/Salem, NC

- Sheraton Suites – Houston, TX

- P&S Business Park- Houston, TX

- Las Cimas I- Austin, TX

- Hampton-Inn Athens- Athens, AL

- Hilton Garden Inn-Huntsville- Huntsville, AL

REALIZED PRIVATE EQUITY INVESTMENTS

The WEDGE Measurement and Control, LLC was established in 2004. The company grew from a small fabricator of 2” through 6” gas metering products with a limited customer base to an industry recognized provider of engineered packages and rental equipment serving the production, midstream, gas transmission, natural gas liquids, industrial end user and gas distribution markets. At its peak, the company generated over $50.0 million in revenue and had over 150 employees. The business was sold in 2016 to Legacy Measurement Solutions.

Formed in 2004, WEDGE re-entered the oil field service business through multiple acquisitions and purchase of new drilling rigs and equipment. WEDGE Oil and Gas Services, L.L.C. provided well services, wireline services and fishing and rental services with a fleet of 62 workover rigs, 45 wireline units and approximately $13 million of fishing and rental equipment through its facilities in Texas, Kansas, North Dakota, Colorado, Utah and Oklahoma. In 2008, WEDGE sold the business to Pioneer Drilling Company (AMEX: PDC) for approximately $300 million.

In 1999, WEDGE made an initial investment for 15% of the common stock in South Texas Drilling & Exploration, a provider of land contract drilling services for the central and south Texas oil and gas industry. In 2000, the South Texas Drilling acquired Pioneer Drilling and subsequently changed its name to Pioneer Drilling Company (Amex: PDC). To facilitate Pioneer’s growth, WEDGE made incremental equity and convertible debenture investments over time resulting in a total investment of $45.5 million. In August 2004, WEDGE began the process of selling off its investment generating cash proceeds in excess of $125 million or roughly 2.75x its investment. In 2012, Pioneer Drilling changes its name to Pioneer Energy Services Corp and currently trades on the NYSE (NYSE: PES). WEDGE continued to trade significantly in Pioneer between 2008–2017 generating over $45 million in capital gains during that period.

Founded in 1947 and acquired by WEDGE in 1974, Howe-Baker was a world scale provider of engineering, fabrication and construction services to refining, petrochemical and chemical processing industries. By 1999 the company generated over $300.0 million in annual revenues and had over 1,250 employees.

Chicago Bridge & Iron Company N.V. (NYSE: CBI) provides conceptual design, technology, engineering, procurement, fabrication, modularization, construction, commissioning, maintenance, program management, and environmental services worldwide. It operates in four segments: Engineering & Construction, Fabrication Services, Technology, and Capital Services.

In 2000, Howe-Baker merged with Chicago Bridge & Iron with WEDGE receiving 48.5% of the common stock of CBI. Concurrent with the merger, WEDGE sold off a portion of its investment for $60 million and retained 20% of the outstanding shares of CBI. The combined company had over $1.0 billion in sales at the time.

In 2000, Howe-Baker merged with Chicago Bridge & Iron with WEDGE receiving 48.5% of the common stock of CBI. Concurrent with the merger, WEDGE sold off a portion of its investment for $60 million and retained 20% of the outstanding shares of CBI. The combined company had over $1.0 billion in sales at the time.